Your ability to earn income is often your greatest financial asset. But an unexpected injury or illness that keeps you from working for an extended period of time can jeopardize this asset.

Without a stable source of income, your best-laid plans — education savings, mortgage payments, retirement goals — can fall like dominos. If you can’t work due to a health issue, long-term disability insurance can provide a source of income.

Do you need long-term disability insurance?

If your ability to work is hampered by a disability and you have dependents, like a spouse or children, you want to make sure you’ll be able to pay for your healthcare and living expenses, as well as maintain your lifestyle and savings goals.

Still, many people tend to forego disability insurance. If you’re relatively young and don’t have a history of health problems, disability insurance might seem unnecessary.

But consider the following:

- One in four adults will become disabled before reaching retirement age. While we tend to think of life-altering disabilities like cancer or automobile accidents, issues like chronic illness, back injuries and diabetes can also prevent you from working.

- The average long-term disability claim is almost 3 years. Yet only 40% of American adults have enough savings to cover 3 months of living expenses if they’re not earning any income.1

What is disability insurance?

Disability insurance is there to protect you if you’re unable to work because of an accident, injury or illness. If you're a small business owner, certain policies may also protect your business and reimburse any covered expenses incurred during your disability. This can help you avoid depleting your emergency fund or retirement savings if something happens.

This is where you might have questions. What qualifies as a “disability”? How much does a plan cost? How much income will it provide in case of injury? The answer is: it depends on the plan.

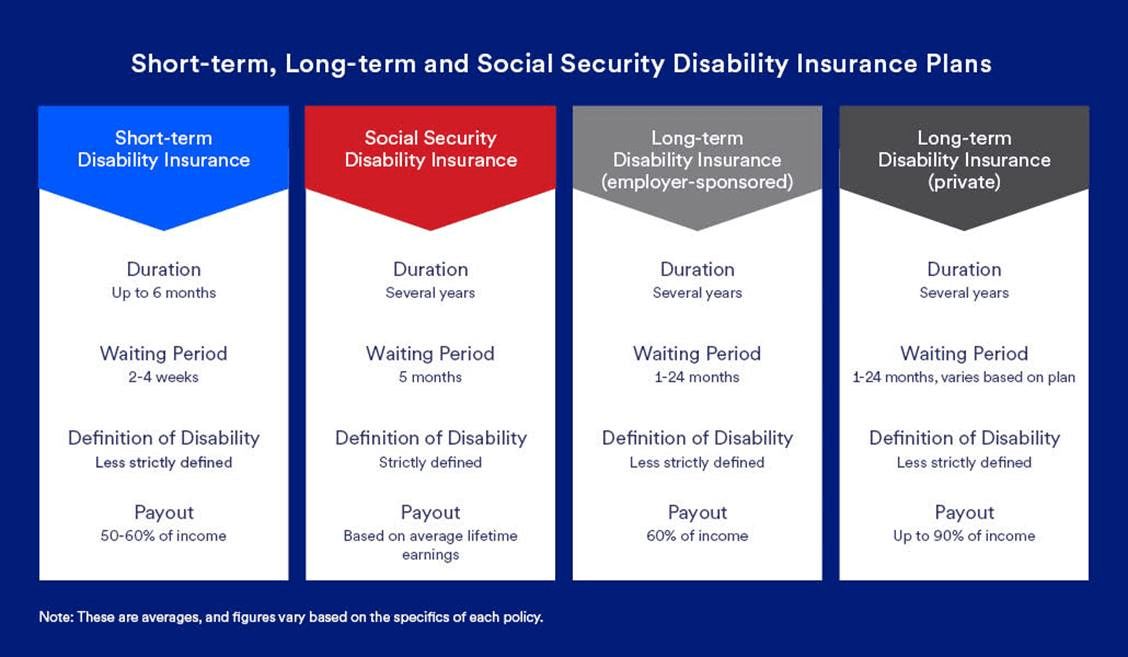

- As the name suggests, short-term disability insurance covers you in the event of a short-term injury or illness — typically 3 to 6 months. This type of coverage is required by employers in some states.

- Long-term disability insurance policies cover longer terms, such as 2, 5 or 10 years. Many mid- or large-size employers offer long-term disability coverage via a group plan like health insurance, but you can get supplemental coverage through an individual plan.

- The government also offers Social Security Disability Insurance, but only to qualified individuals who meet a strict definition of disability and adhere to stringent requirements.

Is employer long-term disability insurance enough?

Many private businesses offer long-term disability plans to their employees as part of a larger benefits package, including healthcare and workplace retirement plans. Employees typically pay a portion of the cost.

However, just 35% of U.S. employees in private industry have access to employer-sponsored disability insurance coverage. And, even if you do have access it, keep the following in mind:

- Employer-sponsored insurance policies aren't meant to cover 100% of lost income. Employer-sponsored policies typically replace about 60% of your income.

- If your coverage is paid with pre-tax dollars, any benefits you receive are taxed, which further reduces your funds.

- Employer-sponsored plans include an “elimination period” ranging from 30 days to 2 years. This elimination period is the time you must wait from an injury to when you can begin collecting benefits. With employer-sponsored plans, you typically don’t have room to negotiate for a lower elimination period. This means that you could end up having to wait longer to begin receiving a disability payout.

Individual long-term disability insurance

An individual long-term disability insurance policy can be used to supplement employer coverage or provide coverage if you don’t have access to an employer plan.

- Individual policies may cover up to 90% of your income — more than what group plans generally offer. If you’re injured or disabled for years, or if you need to rely on disability insurance until you retire, having a source of income that comes close to what you earned while working can be the difference between getting by and living securely.

- Benefits you receive are not taxed, as you pay for coverage with after-tax dollars.

- Individual policies will not terminate when your employment ends, provided you continue to make the required premium payments.

- Individual plans are also more flexible and customizable than employer-sponsored plans. You may decide whether to purchase a policy with a shorter elimination period, so you won’t have to wait as long to receive benefits. You can also opt for what’s known as an “own-occupation” policy, which is beneficial if you work in a highly specialized profession like medicine or law. These policies typically pay full benefits if you’re unable to perform your job, even if you can do another job.

In terms of cost, you can expect to pay 1 to 3% of your annual salary for an individual policy. However, your premium is determined by several factors, including:

- Occupation: the riskier your job, the more expensive the premium.

- Age: if you purchase an individual policy when you’re younger, you’ll pay less.

- Elimination period: the shorter the period between injury and payout, the more you’ll pay.

- Amount paid out: if you want to receive more income in the event of disability, the premium will rise.

- Duration of plan: the longer the plan, the more it will cost.

Considering long-term disability insurance

Whether you’re already covered by an employer-sponsored policy or not, individual long-term disability insurance may help you in case the unthinkable happens. Consider talking with a financial professional to discuss how a policy can help protect you in case of injury or illness.