BREAKING NEWS

New Rules of Options to pay Real Estate Agents went into effect August 17, 2024

BUYERS

CAN CHOOSE IF THEY WANT TO USE, AND PAY, AN AGENT TO BUY A LISTED HOME OR NOT -BUT ARE NOT REQUIRED TO DO SO- BETTER AND LESS EXPENSIVE OPTIONS EXIST

SELLERS

NO LONGER HAVE TO PRESET AN AMOUNT TO PAY A BUYER’S AGENT IF THEY LIST THEIR PROPERTY FOR SALE

---------------------------------------------------------------------

Federal Reserve Expected to cut another 25 basis points

off the fed funds rate at the December 2024 meeting.

If so, this will be the third cut in a row!

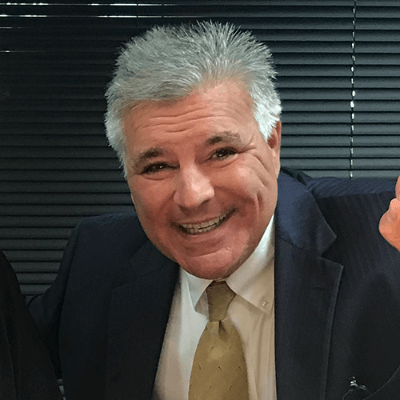

Keith L. Eliou, Esq., CFP, RIA, MBA

- Financial & Retirement Planning

-Mortgages & Real Estate

-Elder Law & Estate Planning

-Asset Protection Planning

-Medicare & Retirement Planning

-Disability and Income Protection

- Life Insurance

- 529s and Education Planning